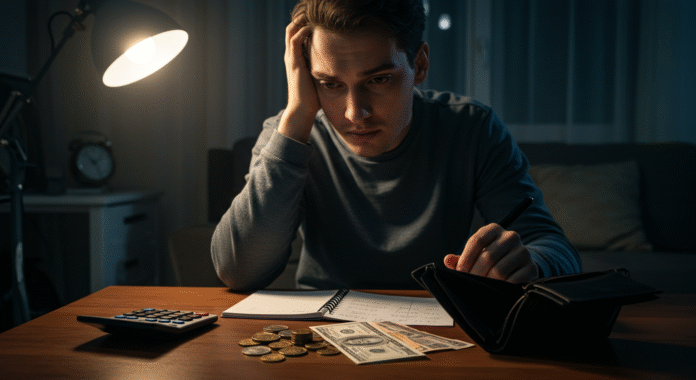

Struggling to Save and Budget My Modest Income in 2025

If you’re struggling to save and budget my modest income, you’re not alone. Inflation in 2025 has made essentials like groceries, rent, and utilities cost more than ever, leaving many with little to set aside. While it feels overwhelming, there are practical steps to stretch your paycheck and regain financial control.

Why Struggling to Save and Budget My Modest Income Is Harder in 2025

Inflation affects everything—food, fuel, utilities, and housing. When salaries don’t increase at the same pace, even the most well-planned budgets collapse. This means:

- Essentials eat up a larger share of income.

- Savings and emergency funds shrink.

- Non-essential expenses often push people into debt.

Step 1: Track Expenses When Struggling to Save and Budget My Modest Income

The first step is knowing where every rupee or dollar goes. Use:

- Free budgeting apps

- Google Sheets or Excel

- A simple notebook method

This clarity helps separate essentials (rent, food, utilities) from non-essentials (subscriptions, dining out, impulse buys).

Step 2: Focus on Essentials First

When struggling to save and budget my modest income, prioritize:

- Housing

- Utilities

- Groceries

- Transportation

Cut or downgrade non-essentials temporarily to make space for savings.

Step 3: Meal Planning & Grocery Budgeting

Food is often the biggest monthly cost. Smart strategies include:

- Planning meals around weekly sales.

- Buying store brands and bulk items.

- Cooking at home instead of dining out.

- Reducing food waste.

Step 4: Reduce Energy & Utility Costs

Small lifestyle shifts can make a noticeable difference when struggling to save and budget my modest income:

- Turn off unused lights.

- Unplug electronics.

- Use energy-efficient appliances.

Even a 10% reduction in your electricity bill helps stretch your paycheck.

Step 5: Lower Transportation Costs

Gas prices remain high in 2025. Consider:

- Carpooling with coworkers or friends.

- Using public transport or biking.

- Combining errands to save fuel.

These small adjustments can save hundreds annually.

Step 6: Manage Debt Wisely

Debt makes it harder to save. Tackle it by:

- Paying high-interest debts first.

- Negotiating lower interest rates.

- Consolidating loans if possible.

This frees up money to redirect into savings.

Step 7: Build an Emergency Fund Slowly

Even when struggling to save and budget my modest income, start small. Set aside as little as $5–$10 weekly. Automate savings to make it effortless. Over time, this builds a financial cushion against emergencies.

Using Community Resources

Many people overlook community support:

- Food banks

- Utility bill assistance programs

- Free financial counseling services

Seeking help isn’t failure—it’s a smart survival strategy.

Staying Motivated When Struggling to Save and Budget My Modest Income

It’s easy to feel defeated. To stay motivated:

- Celebrate small wins (like sticking to your food budget).

- Set realistic goals (like saving $100 in 3 months).

- Revisit and adjust your budget regularly.

Remember: progress beats perfection.

Final Thoughts

Being struggling to save and budget my modest income in 2025 is tough, but not impossible. By tracking spending, cutting non-essentials, reducing energy and transport costs, managing debt, and slowly building an emergency fund, financial resilience is possible.

Every smart step you take strengthens your ability to face inflation—and brings you closer to financial stability.